Choosing where to put your money is tougher than ever. Markets move quickly, interest rates fluctuate, and new asset classes emerge almost monthly. The right decisions can build wealth and long-term security; the wrong ones can see your savings vanish faster than inflation.

Opportunity and risk. 2025 has both. Traditional markets are finding their footing after years of turbulence, while digital assets keep redefining how portfolios are built. The key to success is understanding what drives returns – and balancing risk with reward.

The importance of investments

Money loses value when it sits idle. Inflation chips away at savings, and no high-interest account can outpace it for long. Investing is how people make their money work instead of watching it shrink. Those who figure out where to invest money to get good returns don’t rely on luck – they rely on strategy, patience, and time.

The earlier you start, the more you gain from compounding. Even small, regular contributions can grow into serious capital over a decade. Investing also teaches discipline: you learn to plan, take calculated risks, and think long-term. Whether it’s for retirement, education, or building a safety cushion, investments turn income into assets – and those assets give freedom of choice when it matters most.

Cryptocurrency as a high-potential investment option

Cryptocurrency remains one of the best way to invest money for those seeking higher returns and diversification beyond traditional assets. While price swings are common, the market’s growth shows that digital assets are evolving from speculation into a functional part of global finance. Blockchain now supports payments, lending, and decentralized applications used by millions worldwide.

Investors can access the market in several ways. The most direct route is to buy coins such as Bitcoin or Ethereum through an exchange, gaining full control over the assets and the ability to move them between wallets. Others prefer exchange-traded products and ETFs that mirror the price of major cryptocurrencies but trade through brokerage accounts.

A third approach is to invest in companies that operate within the crypto industry – such as mining, blockchain infrastructure, or payment networks. Each method offers a different balance of control, convenience, and risk.

Top 5 cryptocurrency ETFs. Source: etfdb.com

Among the leading assets in 2025 are Bitcoin, Ethereum, Solana, XRP, and Chainlink. Bitcoin is viewed as “digital gold” thanks to its limited supply and growing acceptance as a store of value. Ethereum underpins the largest ecosystem for decentralized finance and NFTs, while Solana offers faster and cheaper transactions for developers. XRP focuses on global money transfers, and Chainlink connects real-world data to blockchain networks, enabling new types of applications.

Despite the opportunities, crypto is not risk-free. Prices can fall sharply, and digital assets are not insured or protected by traditional financial safeguards. Sensible investors treat crypto as a high-risk, high-reward part of a broader portfolio, investing only what they can afford to lose and holding for the long term.

Handled carefully, cryptocurrency offers access to a new layer of the economy built on transparency and decentralization – one that continues to attract both retail investors and institutions seeking the next wave of growth.

Other investment options

While crypto attracts attention, diversification across several asset classes remains one of the best investments strategies for long-term growth. Each market behaves differently, and combining them helps balance risk and return.

Stocks continue to be a core option for building wealth. They offer ownership in companies and the potential for both dividends and capital gains. Exchange-traded funds (ETFs) simplify access by tracking indexes or sectors, giving investors exposure to hundreds of companies through a single purchase.

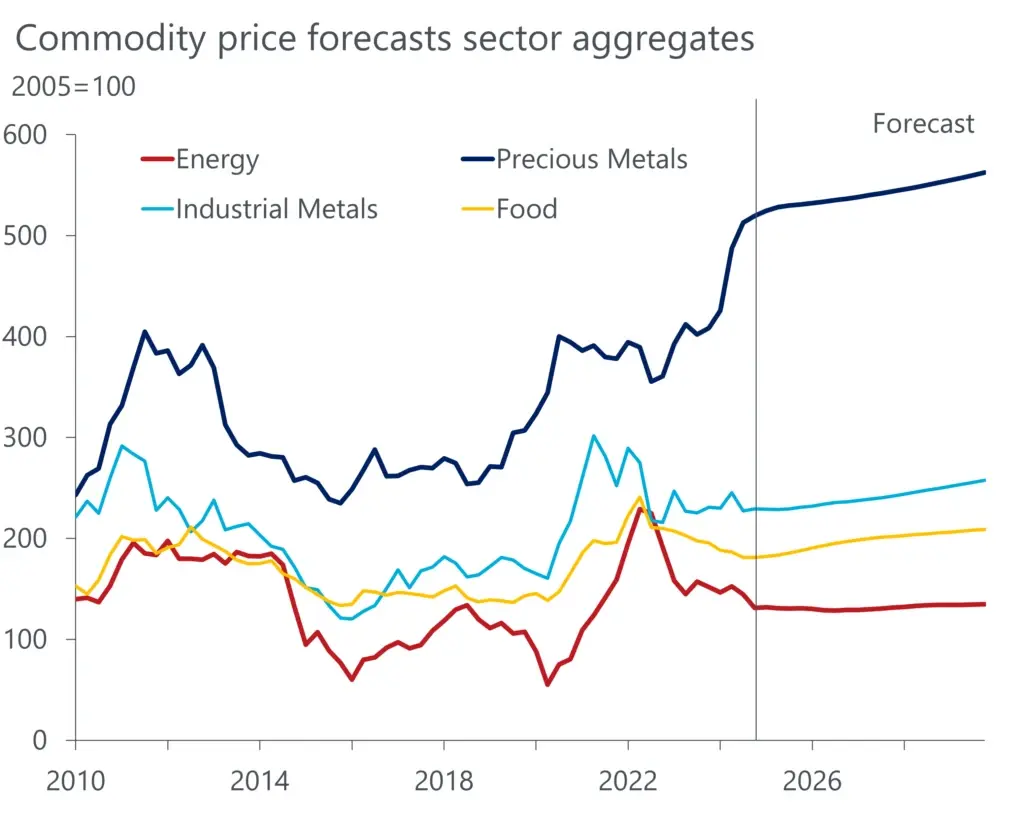

Commodities, such as gold and energy, help diversify a portfolio when markets turn uncertain. Gold, in particular, retains value in times of crisis and can protect against currency depreciation.

Commodity price forecasts by sector through 2026. Source: oxfordeconomics.com

Bonds provide stability and predictable income. Government and corporate bonds can act as a counterbalance to more volatile assets like crypto or equities. Short-term bonds also help protect against inflation and rising interest rates.

Real estate remains a proven hedge against inflation. Whether through direct property ownership or real estate investment trusts (REITs), it offers steady cash flow and the potential for long-term appreciation.

Modern investors also explore alternative assets like private equity, startups, or tokenized real-world assets that merge traditional finance with blockchain technology. The right mix depends on individual goals, time horizon, and risk tolerance – but diversification across these categories is what turns good investments into resilient ones.

What you should evaluate before investing

Before deciding what should I invest in, it’s crucial to understand your own limits and goals. Every portfolio starts not with assets, but with self-assessment.

Risk tolerance defines how much market volatility you can handle without panicking. Conservative investors might focus on bonds, dividend stocks, or ETFs. Those with higher risk appetite can explore growth assets like emerging markets or crypto.

The time horizon matters just as much. If you’re saving for a near-term goal, liquidity and capital preservation come first. Long-term goals, such as retirement, allow more exposure to assets with higher potential returns but short-term volatility.

Finally, align every investment with your financial objectives. Decide whether your aim is income, growth, or protection from inflation. Only then can you build a balanced mix that fits your life rather than chasing trends.

For example, crypto investors often plan around major network events, such as the Ethereum Fusaka upgrade, which can affect performance, staking rewards, and token value. Understanding such changes helps you anticipate risks instead of reacting to them.

Thoughtful investing isn’t about predicting markets – it’s about knowing yourself, setting clear priorities, and letting time work in your favor.

Also Read-Style Meets Celebration: Modern Invitations Fashion Trends